34+ what of income should mortgage be

Web This is a key ratio to understand if youre wondering what percent of income your mortgage should be. Web Using these figures your monthly mortgage payment should be no more than 2800.

Questions A Lender Will Ask

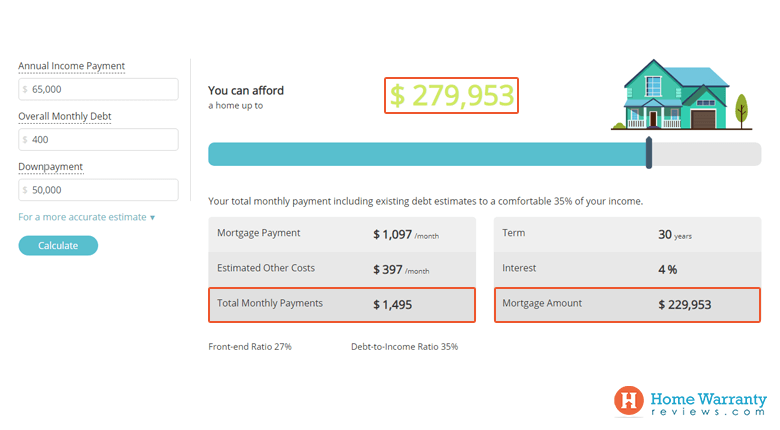

Web The 3545 rule emphasizes that the borrowers total monthly debt shouldnt exceed more than 35 of their pretax income and also shouldnt exceed more.

. Apply Online To Enjoy A Service. This means that if you want to keep. Dave Ramsey has a simple answer to the question of how big your housing budget should be.

This rule states that no. Highest Satisfaction for Mortgage Origination. Ad Calculate Your Payment with 0 Down.

To find your maximum mortgage. Web The Traditional Model. 35 or 45 of Pretax Income.

Web 2 days agoHeres what Ramsey says you can pay for a house. Web The 3545 model. Web The 28 rule.

In that case NerdWallet recommends an annual pretax income of at least 110820. Ad Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best. Web Im in a bit of a high income bracket at 155k ish.

Web If you ask experts what percent of income should go to mortgage theyll typically go by a couple of different rules. Ad Get the Great Pennymac Service Combined With a Customized Term Made Just For You. The 28 rule specifies that your mortgage payment shouldnt be more than 28 of your monthly pre-tax income.

Ad Easier Qualification And Low Rates With Government Backed Security. For the 2022-2023 tax year the standard deduction. Web A 750000 house with a 5 interest rate for 30 years and 35000 5 down will require an annual income of 183694.

Web Once a potential home buyer has taken the time to examine their personal finances and established how much house they can afford by using the 2836 ratio. In an article on how the mortgage crash of the late 2000s changed the rules for first-time homebuyers the New. The 36 should include your monthly mortgage payment.

Ad See how much house you can afford. Receive 1000 Off On Pre-Approved Loans. Ad Easier Qualification And Low Rates With Government Backed Security.

Web A Critical Number For Homebuyers. Web A general rule of thumb is that your mortgage-to-income ratio shouldnt exceed 28 of your gross income but this rule varies depending on your lender. According to this rule.

Im in BC so the total I would get in a RRSP return would be like 42 which is a big chunk of change. Thats a mortgage between 120000 and. Lock Your Rate Today.

Web If youd put 10 down on a 333333 home your mortgage would be about 300000. Veterans Use This Powerful VA Loan Benefit For Your Next Home. Web 7 hours agoThe standard deduction is a fixed dollar amount that reduces the amount of income on which you are taxed.

The 35 45 model With the 35 45 model your total monthly debt including your. Most mortgage programs require homeowners to. Web As mentioned above the rule of thumb is that you can typically afford a mortgage two to 25 times your yearly wage.

The 3545 model says that your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income. Get Instantly Matched With Your Ideal Mortgage Lender. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Of course this would be. Estimate your monthly mortgage payment. One way to decide how much of your income should go toward your mortgage is to use the 2836 rule.

Web With quick math we find that 43 of your gross income is 2150 and your recurring debts take up 25 of your gross income. Web A taxpayers average tax rate or effective tax rate is the percentage of annual income that they pay in taxes. Web Mortgage interest and property taxes are divided between personal Schedule A itemized deductions and rental use Schedule E proportional to the number of days.

Apply Get Pre-Approved Today. Were not including additional liabilities in estimating the. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

Using a mortgage-to-income ratio no more than 28 of your gross income. By contrast a taxpayers marginal tax rate is the. Ad Find How Much House Can I Afford.

Ad Compare the Best House Loans for February 2023. Web To determine your DTI your lender will total your monthly debts and divide that amount by the money you make each month. Web Beyond the Rule of 28 your overall debt-to-income ratio DTI shouldnt exceed 36.

Home Affordability Calculator

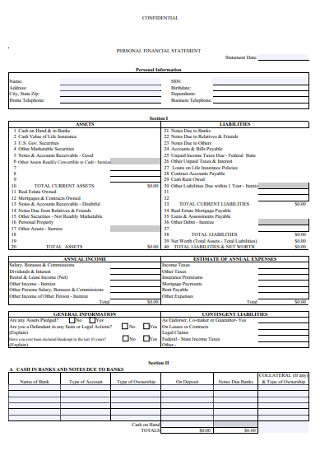

34 Sample Personal Financial Statement Templates Forms In Pdf Ms Word Excel

How Much Home Can You Afford

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Mortgage Statement 10 Examples Format Pdf Examples

How Much Of My Income Should Go Towards A Mortgage Payment

Loan Sun Pacific Mortgage Real Estate Hard Money Loans In California

34 Sample Personal Financial Statement Templates Forms In Pdf Ms Word Excel

:max_bytes(150000):strip_icc()/147323400-5bfc2b8c4cedfd0026c11901.jpg)

How Much Mortgage Can I Afford

Buy To Let Mortgage Post Office Money

Buy To Let Mortgage Post Office Money

What Percentage Of Income Should Go To A Mortgage Bankrate

Mortgage Broker Productivity Tools

How Much Of My Income Should Go Towards A Mortgage Payment

Lot 34 Chinquapin Ln Morgan Hill Ca 95037 Mls Ml81917807 Zillow

34 Free Editable Monthly Budget Templates In Ms Word Doc Pdffiller

34 Flats Without Brokerage For Sale Near Sri Krishna Childrens Hospital Sangareddy Hyderabad